Embarking on the path of client portals can be a transformative venture for financial advisers, or a perilous trek filled with pitfalls. The landscape is littered with those who’ve tried and faltered, their plans unraveling into costly detours. Let’s ensure you’re equipped to navigate this intricate labyrinth.

Ever since the Optus and Medibank Private data breaches last year, client portals have become a keen area for investment. Having a secure method for sending and receiving sensitive information with clients is no longer a luxury item.

In a back-office context, technology adopted poorly may lead to it falling short of expectations and being frustrating but will still be useful to an extent. In the client-facing world of a client portal, poor execution will mean it gets completely shelved.

Even if you have selected the perfect technology, you need to consider all of the following for success:

- Team members need to understand your new portal and see its benefits, otherwise, they will not advocate for it.

- Team members need to trust that your client data is correct, or they will be afraid to use it.

- Your portal needs to meet a real client need, otherwise, clients won’t adopt it and will be frustrated.

These are but a few of the common problems, and there are many. You need to successfully navigate this treacherous path. Go astray even once, and your execution will be a failure. You’ll have wasted time, money, frustrated staff, and possibly frustrated clients.

In this article, we’ll be going back to the start and covering:

- What to consider before researching client portals or selecting a provider;

- What to be aware of in execution;

- Things to get ready for once it is in place.

Look before you leap: A reality check

Shinies! Shiny objects! Gimme, gimme, gimme!!

Beginners, oh. And here they come, come, come to the brightest thing that glitters.

Tamatoa

It’s easy to get distracted by shiny objects.

Oh! Everything in one place, and I’m at the centre! Wonderful!

Oh! They can track their goals against their progress! Awesome!

Oh! They can see their portfolio all together! Excellent!

Despite the shiny features, gimmicks, and whatsits, it’s important to remember why you came and what your core goal is. What you’re trying to achieve, who you’re achieving it for, and what the dealbreakers may be.

What are you trying to achieve?

Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple.

Steve Jobs

What is your ‘cake’, and what is your ‘icing’?

For many right now, given the increased sensitivity of secure client communications, the ‘cake’ is secure communications and a ‘document vault’. With this being a low bar, it then opens up considerations to a wide array of tools that all have strengths and weaknesses. In this secenario, most options are all a selection of what ‘icing’ you want on your cake. This jeapardises focus, since your technology choice isn’t driven by a core vision.

Even if you are looking more broadly, you have to consider:

Are we willing to have multiple login-required tools in our client journey?

Generally speaking, I’d like a single client portal throughout the client journey. It can mean that the effort invested by the client can return on their investment in you increasingly over time. The engagement is simpler and cleaner.

Some exceptions such as a separate portal for deeper portfolio insights or something dedicated to cash flow may be reasonable, but I wouldn’t do so lightly.

If no, what is more important? Serving ongoing clients or onboarding new clients?

No tool is the best at everything, so in a world where you only want to have one tool, it’s critical you know what you want to get from that one tool.

Are you seeking something for onboarding new clients or for keeping ongoing clients engaged? Is this something to enhance the value you deliver or assist you in reducing your cost to serve?

Any particular service may help on many fronts, but which one is driving you? Which one is most important?

Who are you building your portal for?

You’ve got to start with the customer experience and work back toward the technology, not the other way around.

Steve Jobs

Yep, we’re quoting Steve Jobs again. He’s that good.

You should reflect on who you are building this for.

A common issue I hear is ‘removing double entry’, which is a valid concern, however it’s not a client-experience concern. How do clients enter data now? Is this easier for them?

Are you thinking about the client, or your own back office? It’s OK if it’s the back office, but be clear. If you’re making the clients self-serve so you can keep their costs down, that’s completely valid. Being clear on that will help you clearly make choices that help reduce cost instead of improving the client experience.

If it’s for your clients, do they really want this?

Are clients getting this elsewhere? Many banks have offered overlapping features with adviser portals for a long time. For example, Commonwealth Bank’s Netbank login is incredibly easy to engage.

Financial advisers do indeed have a unique opportunity to bring multiple points of data together, across entities and across products. However, if that’s not a problem for your clients, and you’re recommending a single main product >85% of the time, it may not be as valuable as you think.

There is of course a solution for this: Ask them.

Show a trusted friend or family member a promotional video of a portal, and get their honest feedback. Show some clients the video, and ask if they’d want it. Or, even better, find out the key features you’re weighing up against each other and survey your clients on which is more important to them.

What are dealbreakers?

I do not always know what I want, but I do know what I don’t want.

Stanley Kubrick

Even if your head is spinning with options, and you can’t really solve what you want, you can still get clear on what you don’t want.

A common recommendation of mine is to identify any possible dealbreakers as you can as early in the process as you can. These are just absolute no-go zones, you’d rather have nothing. Some examples from my experience include:

- Are cyber security certifications held?

- Can clients update details without the practice being notified of the change?

- Can we have a single moment of review, affirmation, and lodgement of details that can be referred to in the future?

- Are digital signatures included?

- Will this integrate with my CRM?

Some providers allow you to hide certain aspects of the interface or certain functionalities, which can make this much simpler. I hope to see more developers taking this approach over time.

Exit strategy

Technology goes wrong, mistakes are made. What happens next?

Client portals are the absolute worst for this. It’s not just changing tech, it’s changing client-facing tech.

When selecting a tool ask yourself: Is there anything that would be hard to replicate elsewhere? Reason being, taking away a functionality is going to have a far greater impact than never having provided it the first place. A service you can deliver reliably may well be better than a lot of services you might not be able to sustain.

What assurances do you have that you can exit easily? For those with lock-in contracts, what would happen if they had a data breach? How is data deleted?

Can past clients or prospects access the service? Will you have visibility over those? Do you even want visibility?

If terminating access, that may impact how you present it if it is indeed an onboarding tool. Keep in mind, these days maintaining access to data beyond when you need it is a bad idea. Unless that data is being put to good use, it’s a liability.

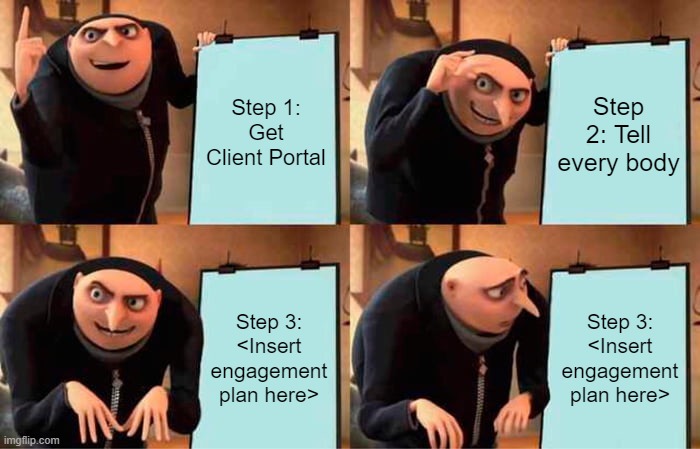

Transition planning

A rollout half-arsed is worse than none. Better to commit the resources including a buffer for learnings you make along the way, or decide early not to roll out at all. For tools that are valuable ongoing, how you transition is essential.

Before committing to something new, consider the change management and client engagement required.

Alpha Testing

Alpha phase testing is for once the product is live, and is usually for staff, friends, and family only.

It’s worth asking yourself, will every one of your staff use it? (If not, why not? Is it because they don’t have a portfolio, are on top of their cash flow, or because they don’t think it’s helpful for them? A danger sign in innovation is when people say others will like something, but not want it themselves.) Keep this in mind, if your staff won’t use it themselves it makes it harder to understand and support the client experience.

Beta testing

A beta test phase in software development is with sample end clients.

Piloting is important. Don’t be tempted to only pilot with your easiest most tech-savvy client, consider:

- Piloting with the client that has the most to gain. If they don’t enjoy it, then it’s not worth rolling out. That goes not to just how we roll out, but if we should.

- Pilot with Mr Joe Average, someone who is patient enough and would be OK if it doesn’t work out. Other metrics be damned, being able to walk this back will be important if it fails.

- Pilot with a late-adopter client (laggard or full luddite may be too far, but someone who will struggle). This will go to how we roll out.

If the products you’re looking for have a lock-in contract, which is common, this may not be realistic. As the next best option, send some likely pilots a video and ask them if they’d value that. You can also include it in a client survey (if you need help running a client survey, contact us and let us know). No reason why you couldn’t send that to your intended beta testers even before making the commitment to the software you’re buying!

Go live plan

Check to see:

- Will this be for new clients only?

- Will you transition all existing clients in bulk, or at review?

- Will you stagger rollout through one adviser in the practice, or all at once? (Staggered is usually a win here).

- Will you be preloading all products where you are the listed adviser? If it’s a branded portal, that’s what I’d expect to see as a client. Hard to roll that out in bulk.

Some very basic training and resources will be required, beyond just sitting down to a 60 minute training video.

- Does everyone know the URL?

- What is the process to add a new client to the portal?

- How do you reset the password?

- What are data security questions a client may ask? What are the answers?

- What are the unintuitive quirks that clients should be given a heads-up about

- What do we need to remember when processing in back office?

A quick reference one-pager cheat sheet for all to use is highly recommended for these questions.

Making the client portal a part of your offer

Ongoing engagement plan

Depending on what you plan to use your tool for, you may need to work on clients on an ongoing basis to keep them engaged.

If your new tool is going to be how you communicate, your team and your clients will need to get into new habits. Going forward:

- You don’t email the Statement of Advice, you upload it to the portal.

- A client doesn’t email you their ID, they upload it to the portal.

- You don’t tell us your new financial details, you populate the portal.

Some other key things to consider are:

Setting expectations

Clearly outline what features and data will be consistently updated in the portal and at what intervals. Are the insurance details continuously up to date, or will you update at review? Consider setting these expectations both verbally and in written form, like an FAQ page or an introductory email.

Fee Disclosure Statement caveat

Be cautious about including the portal in your Fee Disclosure Statement. Doing so could back you into a corner. If a client opts out or if you decide to switch platforms, it could create unnecessary complications.

Mandatory or optional?

Decide whether the portal will be mandatory for all clients or an optional resource. This decision will have ripple effects on both your service offerings and your resource allocations.

Showcasing on your website

How you present this new feature on your website will vary based on its role in your service package:

- The Subtle Button: If the portal is just another feature, a simple login button may suffice.

- A Brief Mention: A line or two in the services or FAQ section would be adequate if the portal is optional but beneficial.

- The Sales Pitch: If it’s a major value-add, consider a separate landing page or section to really sell it.

- How-To Guides: If you believe you offer a superior experience to existing options, short video tutorials or infographics can serve as useful guides for your clients.

Final thoughts

Remember the key principle: Do the fewest possible things, and do them well. Don’t compromise quality for quantity, and be clear on whether this is for the client or for your back office.

Hi Patrick,

Thank you for sharing such valuable insight.

Cheers Andrew

Glad you found it helpful Andrew! Makes my day!