Last week, Stephen Jones, Assistant Treasurer and Minister for Financial Services, announced significant changes to financial advice regulation over three streams, with the ‘Stream one’ to include:

The “Safe Harbour” steps will be removed from the Best Interest Duty with consultation to determine implementation details originally designed to protect financial advisors and the implications of adopting the remaining parts of recommendation 5 (accept in principle part of recommendation 5).

Statements of Advice will be replaced with an advice record that is more fit‑for‑purpose, with consultation to determine the final design of the replacement (accept in principle recommendations 9).

Stephen Jones, ‘Delivering better financial outcomes – roadmap for financial advice reform’, 13 June 2023

These are potentially enormous changes. In this blog I’ll cover:

- What a ‘fit for purpose’ advice record could mean

- What a ‘fit for purpose’ advice record won’t change (and what you should be doing now)

What a ‘fit for purpose’ advice record could mean

Looking past the announcement itself, and more at the recommendations relating to the Statement of Advice (SOA) which is being accepted in principle, we see:

I am recommending that the law be amended to remove the requirements for a SOA or ROA, as I had proposed. I am also recommending that the provider of advice maintain a contemporaneous record of that advice; and give the client a written record of the advice if the client requests written advice before or at the time the advice is provided.

Michelle Levy, Quality of Advice Review

Given it is an ‘in principle’ acceptance of this recommendation, there’s a lot of room to move in this. I’ll cover a few elements of what a ‘fit for purpose’ advice record could mean.

A ‘Short-Form’ advice record

One of the challenges in trying to simplify too far is that you still need writing to communicate certain concepts. A side-by-side comparison of fees, including a breakdown of who gets what? Whether it’s in a video as a slide or a visual aid in a meeting, someone is writing something and it has some dense detail.

Borrowing from the principles applied to Product Disclosure Statements (ASIC RG168.9), there’s a significant opportunity to tick a lot of boxes all at once.

A ‘Short-Form’ document would still have a mandated ‘in writing’ component. Still, it could be supported by other resources with a clear view to incorporate by reference, enabling the process to be supported by other record-keeping (recordings, file notes, etc.).

Given the conflicts relevant to advice have been reduced since SoAs came into being, it’s fitting for the disclosure required to be reduced to match. Gone are the days of complex kickback calculations, disclosures of loans made and repaid through product support, and the like. With that in mind, disclosures such as other interests and associations or relationships (Corps Act S947C(f)) are increasingly similar (if not identical) in each SOA and could be removed or incorporated by reference to the Financial Services Guide.

Other strategic advice can have a wealth of ‘Risks and disadvantages’, many of which are low likelihood and/or low impact. These should be available to the keen reader or concerned client as an optional resource. (We’ve written more about this in a previous blog: A thought process of how to approach Statements of Advice (and other complex advice documents).

Capturing client goals, ensuring the clients understand the key concepts, and discussing risks and trade-offs, could all be better suited to a recorded verbal delivery so long as all advice doesn’t need to be delivered at a single point in time.

Conceptually, in digital user interface design, ‘progressive disclosure’ is a powerful tool to ensure users aren’t overwhelmed at any point. A ‘Short-Form’ advice record could achieve much of this.

Advice records when the purpose is strategic

We would love to see advice tailored to the risk of the advice, considering the risk to the client in particular.

Strategic advice, which doesn’t include any reference to a financial product (including superannuation generally), could be such an area for huge improvement.

Take this example:

Currently, a client who has surplus cashflow and will not meet their retirement objectives cannot receive a simple recommendation to salary sacrifice to superannuation.

Sure, it’s easy to think of what could go wrong.

Saving for retirement might not be a goal of the client.

Reducing tax might not be a goal of the client.

Perhaps the funds should be used for something else, like repaying a mortgage, non-super investment, or funding insurance.

However, all of these elements could be covered in a short conversation, but that’s just not possible at present.

Even without a specific superannuation product being mentioned, this becomes a significant advice document.

Questions regarding goals need to be explored and documented, all pros and cons need to be considered and disclosed, strategies need to be linked back to those explicit goals, and alternatives need to be considered and evidenced.

The risk to the client is low. It’s a salary sacrifice, it’ll have a modest impact each pay cycle and can be stopped with ease. There are risks to the client, however, these could be covered with a static one-page flyer (similar to the one-two page disclosure you receive prior to brain surgery).

In such a situation, a client-facing advice record may not be required. A recording of the meeting could be sufficient and would more closely align financial adviser requirements with those of superannuation fund call centers who would make the same recommendation easily by phone (conflict and all).

Advice records when the purpose is unlinked to a conflict

Another way to look at ‘fit for purpose’ could be from the other direction, starting with the adviser rather than the advice or the client.

There are always risks of conflict in advice, but where the direct impact of the advice does not include an additional cent going to the adviser, these risks do not merit the current complexity. Currently, the ≈2% of advisers who are truly ‘Independent’ (as defined by Corps Act 923A) are governed by the very same rules as an institutional adviser recommending in-house products whilst charging upfront and ongoing percentage-based fees on all funds.

Most of the regulations surrounding Statements of Advice are there to protect consumers from the inherent conflicts of interest attached to financial advice. In this context, where there is no material scope for conflict, the requirements are not fit for purpose. The outcome is a waste of time for the business, with delays and costs for the client.

An ‘independent’ adviser, charging fixed fees, would have absolutely no conflict in the above ‘salary sacrifice’ example. A record fit to the purpose of protecting the consumer in such an example could appropriately be a recording of the meeting, similar to a ‘Record of Advice’ requirement without the need for a preceding SOA.

What a ‘fit for purpose’ advice document won’t change (and what you should be doing now)

Whilst it’s interesting to consider what could eventuate, It is important to note what isn’t being proposed. This is clearer and helps us individuals and practices within the profession focus on controlling the controllable.

Best interests duty

What’s not changing

Best interests duty is not being removed, only removing the safe harbour steps has been proposed.

6.52. Safe harbour

When ASIC undertakes file reviews, they do in fact look at whether the safe harbour steps have been followed and where they have not, they ask whether the advice is still in the best interests of the client by considering whether the safe harbour steps have been followed in substance. It would be a brave adviser that does not follow the safe harbour steps. And the feedback we received from advisers was that most are not so brave. That might be appropriate if it ensured that consumers got the advice they wanted or even if it ensured that consumers did not get poor advice. But they do not.And so I am recommending that, together with the existing best interests duty the safe harbour be repealed. They should both be replaced with a new duty for a financial adviser to act in the best interests of the client when the adviser is providing personal advice.

Michelle Levy, Quality of Advice Review

Take this to the next step.

What will ASIC do now when conducting file reviews? Do you think they will stop having a checklist? If no, what’s on that checklist? Will it change with the removal of the safe harbour steps?

Advice never had to rely on the safe harbour steps, but they were there to give the profession certainty of what to do. In its absence, risk managers would be reasonable to think that without further clarity on what ‘Best interests’ looks like, many will retain the current checks in the absence of better guidance.

What you should be doing now

Whilst you still need to meet best interests, the removal of the safe harbour steps may well help the more progressively minded practices.

Effective process, clear policies, and most importantly the right culture may give more hope than clinging to safe harbour did previously. Before this change, a black-and-white risk manager might suggest that all those things might keep you safe, but safe harbour will. Without safe harbour, perhaps the focus can be on those more important areas.

Ensuring you have a strong culture, the right incentives, good controls, and effective process will be more important with this change. Not less.

Good practices have been doing this already, for a long time, and consider it a matter of continuous improvement.

Existing instances where disclosure goes above legislative requirements

What’s not changing

The documentation provided with financial advice for many goes far beyond what is required by ASIC and recommended by APRA.

Consider a few examples:

- Every advice document which disclaims all disadvantages beyond the point where it would inform a client to make a decision; exceeds current requirements.

- Every advice document that details alternative strategies in writing that the client did not ask for, and did not want; exceeds current requirements.

- Every single Record of Advice sent to a client that they did not ask for; exceeds these requirements.

Whilst we might bemoan legislative requirements, there is much that can be done within the current framework which is not presently done by many.

What you should be doing now

If you do any of these things currently, you’re not waiting on legislative relief to improve your advice process. You need to consider how you effectively manage risk.

Improving the above will not only pay certain dividends now, but will also position you to act more quickly in response to future changes.

We’ve written on some creative approaches to risk management here: Applying the Swiss Cheese Model to advice.

Record keeping

What’s (probably) not changing

An emphasis on the consumer is great, but a significant component of SoA production is the work that maybe shouldn’t be presented to the client but needs to be done anyway.

Even though the Corporations Act, ASIC, the Code of Ethics, or other obligations may not lead to a written outcome, they still need some kind of evidenced record. If it is a requirement, it requires evidence. If it requires evidence, you probably want to support that with process.

What you should be doing now

Right now, no matter the form of the advice document to come, you can look at aspects of your processes that:

- Support advisers to make recommendations efficiently.

- Improve the effectiveness of communication from adviser to paraplanners.

- Apply appropriate checks to ensure advice meets all requirements early in the process to prevent waste.

These are broad strokes, but almost all steps surrounding the advice preparation will still require checking, will still require appropriate file notes and research evidence, and will still need to be good recommendations.

Scope for regulatory misfire

What’s not changing

The only constant in life is change.

Heraclitus

Regulatory risk isn’t gone, we’re not about to enter a world of daisies and rainbows for financial advice. Change can be exciting, and I’m glad the pendulum is swinging back after such a dramatic swing too far on many fronts, but we’re not out of the woods.

I’m very excited about the recommendations regarding Fee Disclosure Statements which were a clear-cut Compliance requirement, with little (if any) benefit to anyone. However, the method for advice delivery will be and always has been more complex.

One need only look at the hilariously drafted ‘small investment advice’ option for a Record of Advice (Corps Act 946AA), which despite its goal of enabling advice easily for low balances, was ultimately so complex that it became unusable. Now it’d be more likely to be referenced in a Compliance Team trivia game than an actual practice policy document.

What you should be doing now

Ensure you aren’t banking on regulatory change to solve your business problems. Whilst you may redirect your investment to areas less likely to change, these changes should not be and are not the panacea we would all love to benefit from.

Conclusion

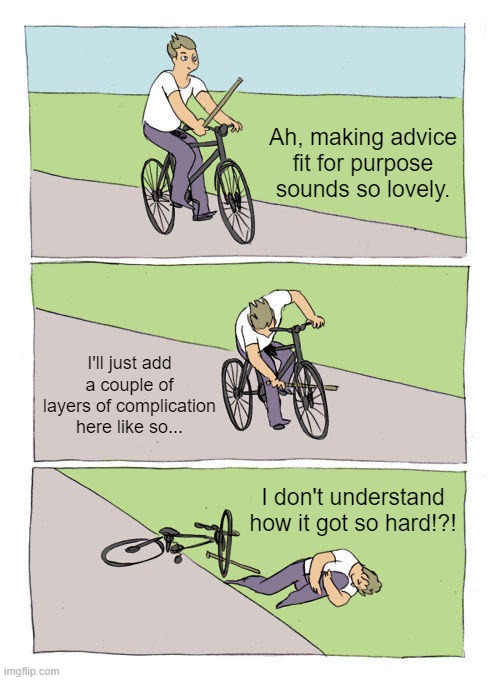

I’m excited for the potential for change. The potential for an advice record to be more fit-for-purpose could mean many things. The purpose could be shorter form communication, strategic-only advice, independent advice, or some other purpose, there’s no way to know at this point.

What we do know is that the problem statements behind the proposals are excellent, and the perspective is the right place to start. The opportunity for flexibility in this space could indeed open up this key ‘Moment of Truth’ (as McKinsey would call it, or ‘Moment of Trust’ as I call it in advice).

All that said, legislative requirements are but one (albeit major) input into the ideal advice process. It’s true, they can and often do loom so large they obscure the changes advisers can make today. But, that’s only ever been part of the picture.

Delays to date, and inevitable delays to come, are on the government of the day. The rest of what you can control, the ocean of improvements you can make in your business, are on you, today.

If you’d benefit from leaner financial advice operations, book a virtual coffee with me and let’s have a chat about how you could be doing more, today!

Love this article!

Love that you love it Sara! 😀