Ever had a case go absurdly wrong? If we didn’t have a typo in the email address, and the adviser hadn’t cut that corner, and the SoA wasn’t prepared by the new paraplanner who we hadn’t trained fully…. It wouldn’t have happened. A comedy of errors. We’ve all seen it happen. You probably didn’t realise it at the time, but that’s the Swiss Cheese Model of Accidents in action.

In this blog, I’ll be introducing the Swiss Cheese Model of Accidents from the accident management industry and applying it to the financial advice context. This article will be a little less practical and a little more theoretical than my other work, but will present a framework you can use to help to think about and communicate risk management in advice.

In this article we will be covering:

- What the Swiss Cheese Model is

- How it can be applied to the advice context

- How it can be applied positively to make advice better

Introducing the Swiss Cheese Model

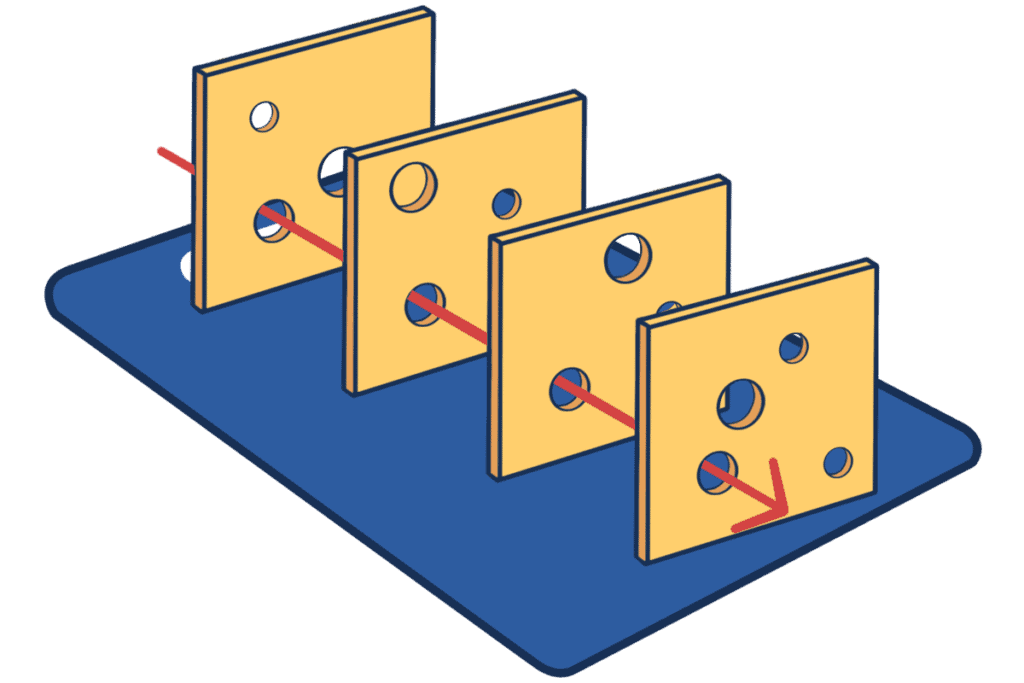

The Swiss Cheese Model operates like so:

Imagine you have a number of slices of Swiss Cheese (which of course has holes in it).

If you had five slices, and put them in a stack, you probably wouldn’t be able to see all the way through.

However, if you change the circumstances and realign them lots of times in lots of different ways, you may find a combination that allows you to see all the way through.

Now, imagine each slice of cheese is a layer of defence in the advice process, and instead of being able to see through, each piece of advice has a chance to get through all the layers to the other side and become a fail. (A fail being a breach, successful complaint, or being otherwise unacceptable.)

It’s a model most famously used in the air safety industry, where catastrophic failures typically stem from a series of failures across organisational systems, hardware/software systems, and human error. It’s sometimes referred to as the Reason model after it’s developer Prof. James Reason. (Which I’m putting down to some people thinking talking about risk management in terms of cheese is silly. I, for one, think it’s great.) It’s described well here:

“Accidents in complex systems occur through the concatenation of multiple factors, where each may be necessary but where they are only jointly sufficient to produce the accident. All complex systems contain such potentially multi-causal conditions, but only rarely do they arise thereby creating a possible trajectory for an accident.”

Reason, Hollnagel, and Paries writing for Europoean Organisation for the Safety of Air Navigation

OK, so let’s see how we can apply that to the advice context.

Applying the Swiss Cheese Model to advice

To think of it in mathematical terms, consider this simplified example:

Risk of implementation without an ATP being signed

Factor A: Chance of adviser progressing advice to Implementation stage without a signed ATP (through either error or deliberate policy violation): 1/100.

Factor B: Chance of implementing colleague proceeding without completing step to verify ATP has been signed: 1/100.

As a result, the risk of implementation without a signed ATP is:

Risk of factor A x Risk of factor B = 1/100 x 1/100 = 1/10,000

In this example, you can see how having implementation managed by a colleague other than the adviser reduces the risk of this particular error from 1/100 to 1/10,000. A big impact.

The Swiss Cheese Model encourages us to think about risk as an end-to-end process. It encourages us to think about risk control as multi-faceted. It encourages us not to look at singular aspects and make declarations about what is appropriate at a single given step, but to see the big picture.

Looking at the broader system, we can think of some of the below parts of the system as layers in our block of Swiss Cheese.

- Organisational

- Resourcing

- Infrastructure

- Communication

- Environmental

- Conflicts of interest

- Opportunity (eg: vulnerable clients)

- Organisational stress (eg: debt stress)

- Individual

- Education

- Stress (client:adviser ratios)

- Defences/controls

- Pre-vetting

- Internal controls (eg: Independent paraplanning)

- BID checklists

Each of these layers represent factors that contribute to risk and it’s management.

Thinking in these terms, it’s easier to start seeing how organisational level decisions impact the amount and types of controls required.

Applying the swiss cheese model to improve process

This should not be seen as an argument for more layers or controls in risk management. Rather, using the Swiss Cheese Model helps demonstrate that risk management is not something just for Compliance managers, but for everyone controlling every aspect and every step in an organisation.

Using the Swiss Cheese Model, we can go beyond simply implementing controls and policies to manage risk. We can implement a number of positive changes, and even remove some of the more arbitrary ones.

I recommend taking the following approach when looking to solve a particular risk problem.

Add layers which also improve your client experience

There are lots of ways to slightly reduce risk with small changes and each one adds another thin layer to the Swiss Cheese Model. Some of these initiatives improve the client experience. Here are some examples:

- Confirming key decisions in any advice meeting via email.

- Sending the SoA to the client in advance of a presentation.

- Implement training on how to have better client conversations on tough topics.

These options all provide opportunities for clients to improve their understanding of what is going on with their advice and provide a client record which is harder to challenge.

Add layers which also improve efficiency

There are lots of ways you can add layers that improve efficiency. Some examples include:

- Provide self-service options into the advice process (digital fact find, DIY client engagement tools) which create a record of the clients’ direct entry

- Invest in software/process that enhances back office efficiency and record keeping.

- Document a detailed advice philosophy that guides and supports advice.

There are many more ideas on this front within our blog titled Rethinking the not so humble File Note.

Add smarter layers

There might also be some opportunities to add layers that you feel are smart ways to reduce risk without too much impact on the client experience and efficiency.

- Do not authorise advisers to implement advice, have that done by support.

- Collecting client feedback at the end of the advice process. If they’re not happy, you can proactively address before things get to complaint.

- Leverage technology solutions like Tiqk, Advice RegTech and RedMarker. (More for licensees or larger practices.)

Now consider removing existing layers which slow you down and/or disrupt the client experience

Thinking about each of the above as a layer of Swiss Cheese, we might now be able to re-examine some existing layers which aren’t so necessary given the new layers we have in place.

- Do we still need a signature on a fact find if we now collect much of our data through self-service forms or via 3rd Party Authorities?

- Do we need an Authority to Proceed for a Record of Advice, when we’ve confirmed the conversation via email afterwards?

- Do we need to exclude some strategies at a policy level (LRBAs for example) for a practice that has two ARs approve each document before it is sent out? (ie: The adviser and an authorised paraplanner.)

This is where the Swiss Cheese Model is helpful when discussing compliance and risk management. You can start to see how all aspects of the advice process contribute positively and negatively to risk.

An ‘Independent’ practice or licensee rightly should have less controls in place when compared to a conflicted one. A multi-adviser firm with robust processes and strong investments in technology should be at liberty to skip some compliance checks which are more appropriate for a single owner-operator Luddite.

Next time you’re considering how to manage a particular risk, don’t just think about how you can prevent something from happening with a single step. Consider the end-to-end process. Think of all the good layers you can add (CX/Efficiency friendly) before you decide on what other less-friendly controls to put in place.

Further reading: Revisiting the Swiss Cheese Model of Accidents by Reason, Hollnagel, and Paries writing for Europoean Organisation for the Safety of Air Navigation, 2006.

If you’d like to learn more, you can subscribe to get future updates below. My next blog will be talking about the Red Wine Method of Innovation. (Kidding!)

If you found this blog helpful, please consider commenting below or sharing via social media, as it helps our good work get noticed!

Good graphical representation of the alignment of the holes in a number of slices of Swiss Cheese model.

I had not heard of this before. Is this a commonly used model.

• • •

Regarding “Think of all the good layers you can add (CX/Efficiency friendly) “,

what is CX?

• • •

I have not worked so much with Risk persay while some of my past work has dealt with probability to multiple events similar to your example with

Risk of factor A x Risk of factor B

Thanks Bi! I’m glad to hear it resonated.

In advice, it’s not a risk management model I’ve ever heard of. That said, I think it’s very applicable for any complex system where managing risk has significant impacts.

And apologies for the jargon. CX is ‘Client Experience’.